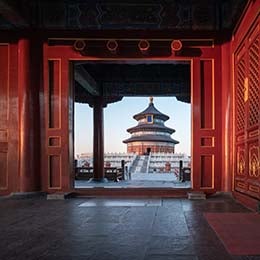

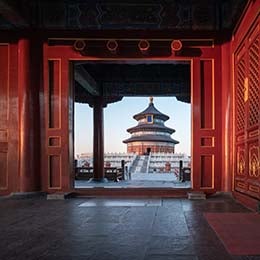

The case for emerging markets and Chinese equities

The performance of emerging market equities depends in large part on China. Here’s what we’re watching as the trade war continues.

Our global strategy4 was one of the first in the world, and has had only four managers since its launch in 1969.

On average, our team members have spent 15 years at Invesco and 24 years in the industry.5

Two strategies recognized by the leading global investing benchmark Refinitiv Lipper for 9 awards over the last five years.1

The average US investor holds nearly 76% of their stock portfolio in US companies. And yet, only 24% of gross domestic product (GDP) is from the US.² Are you limiting your opportunity set? Great companies around the world are capitalizing on transformational forces, including the growing middle class, the technological revolution and the aging population.

The middle class is fueling growth in goods and services such as luxury items and travel.

By 2030, the size of the global middle class is expected to reach 5.3 billion, or a third of GDP growth3.

Technology is helping every industry work faster and smarter.

The cloud computing industry alone is predicted to grow from $371 billion in 2020 to $832 billion in 20256.

People around the world are living longer and spending differently.

The number of people 65 and over is expected to double in the next 25 years, and they're already spending more to be healthy and active7.

Through our time-tested, active approach to global markets, we’ve discovered enduring opportunities around the world to help our clients achieve their long-term financial goals.

The Global Equity Team has been a leader in global investing for more than 50 years. The team launched its flagship Global Fund back in 1969 and, over time, thoughtfully expanded its product offerings to include an array of products designed to meet a diverse set of investor needs.

| Fund Name | Ticker | Description | Download |

|---|---|---|---|

| Invesco Global Opportunities Fund | OPGIX | A highly active and differentiated portfolio comprised mainly of small- & mid-cap emergent growth stocks with transformational potential. | Fact sheet |

| Invesco Global Focus Fund | GLVAX | A concentrated, unconstrained, style agnostic portfolio investing in companies that may have the potential to compound value through durable competitive advantages and leadership in a structurally growing area of the economy. | Fact sheet Infographic |

| Invesco Global Fund | OPPAX | Flagship global equity product focused on high-quality, large- cap blue chip companies, investing with a long-term horizon and patience to allow compound growth potential to play out. | Fact sheet |

| Invesco Oppenheimer International Growth Fund | OIGAX | A differentiated, high quality portfolio of international stocks with a wide range of structural growth drivers. | Fact sheet Infographic |

| Invesco International Small-Mid Company Fund | OSMAX | A hig6eh-quality portfolio focused on international small- and mid-cap companies that may have the potential to compound returns for shareholders over time. | Fact sheet |

| Invesco International Diversified Fund | OIDAX | A fund of funds designed to be a one-stop solution for broad international equity exposure with an attractive balance between risk and reward. | Fact sheet Infographic |

The Emerging Markets Equity Team has been investing since 1996 and lead PM Justin Leverenz offers clients over 27 years of experience. He takes a high conviction approach to emerging markets equity investing, with a focus on high quality innovative companies that may benefit from structural growth tailwinds.

| Fund Name | Ticker | Description | Download |

|---|---|---|---|

| Invesco Developing Markets Fund | ODMAX | An emerging markets equity strategy focused on companies with durable long-term growth, sustainable advantages, and those rare companies that have considerable real options often unappreciated by conventional investment strategies. | Fact sheet Infographic |

The case for emerging markets and Chinese equities

The performance of emerging market equities depends in large part on China. Here’s what we’re watching as the trade war continues.

Digital payments: Dethroning cash as king

Virtually everybody has been exposed to digital payments by now. It may seem that this shift away from physical money has come all at once, but it really hasn’t. Randy Dishmon shares where the Global Focus portfolio management team is seeing investment opportunities in the digital payments space.

NA3076757

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Derivatives may be more volatile and less liquid than traditional investments and are subject to market, interest rate, credit, leverage, counterparty and management risks. An investment in a derivative could lose more than the cash amount invested. Stocks of small and mid-sized companies tend to be more vulnerable to adverse developments, may be more volatile, and may be illiquid or restricted as to resale.

These funds are subject to certain other risks.

The funds are subject to certain other risks. Please see the current prospectus for more information regarding the risks associated with an investment in the fund.

There is no guarantee that forecasts will come to pass.

All data sourced to Invesco unless otherwise stated.

Diversification does not guarantee a profit or eliminate the risk of loss.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.