Innovation How the Nasdaq-100 shapes your morning commute

Discover how Nasdaq-100 companies drive modern commutes with innovations in semiconductors, mobility, and cloud tech, featured in Invesco QQQ’s portfolio.

See how groundbreaking innovators are changing the world.

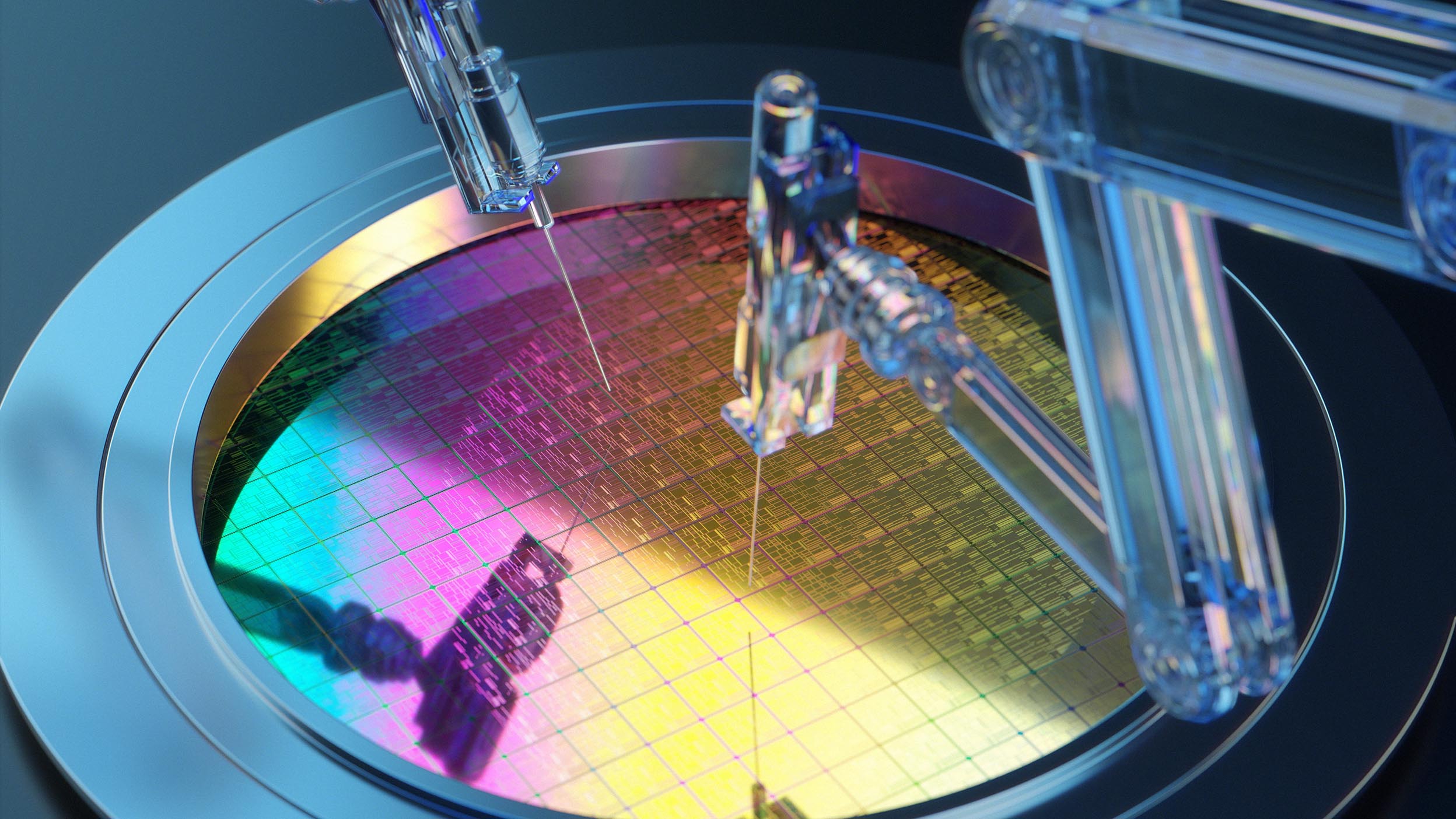

Learn how semiconductors are providing the computing horsepower to drive breakthroughs in AI and other cutting-edge areas.

01:00:01:04 - 01:00:22:05

Ryan McCormack (Invesco QQQ)

It's a little surprising at times when you take a step back and look at all the devices in your home that are connected to the Internet. The ability of what we can do with these devices is now unfathomable compared to ten or 20 years ago. And ultimately, it all sort of comes back to the driving force behind a lot of these components, and that would be semiconductors.

01:00:26:19 - 01:00:46:05

Ryan McCormack (Invesco QQQ)

What is QQQ? An excellent question. We like to joke here that it belongs on the Mount Rushmore of ETFs, because there's not many that can say that they have a 20-year live track record. What I find exciting is Invesco QQQ is empowering investors to become agents of innovation, across industries, across companies that are shaping the way that they live their daily lives.

01:00:46:11 - 01:00:52:00

Ryan McCormack (Invesco QQQ)

QQQ is very different in that it's based on a rock-solid partnership with Nasdaq.

01:00:52:00 - 01:01:14:23

Karen Snow (Nasdaq)

The Nasdaq-100 is home to the biggest and most disruptive companies in tech. Semiconductors are really the brains behind all of the computing and innovation that we see across every sector. So they're really the heart of all of that innovation. I would say Microchip, KLA and Honeywell are all leaders as it relates to the semiconductor industry.

01:01:15:01 - 01:01:25:09

Vimal Kapur (Honeywell)

I don't think two decades back we had any electronics in our homes in form of semiconductor or in our cars. And today I'm not aware of any product where there’s no semiconductor.

01:01:25:15 - 01:01:45:05

Mark Shirey (KLA)

The end use of computer chips is so varied these days. You have huge data centers, you're managing our social networks and everything we do online. You have things like autonomous driving, electrification and increasing chip content in cars. You have smartphones, wearables.

01:01:45:09 - 01:02:07:12

Ganesh Moorthy (Microchip)

In the early years, making it smaller meant you were able to make it less expensive. You were able to get higher performance. Today, it's more important to also think about what kind of functionality can you pack into it, so that you can have a single chip or a small set of chips that are able to provide the type of functionality, the type of innovation you need without only thinking about performance and power.

01:02:07:22 - 01:02:27:14

Vimal Kapur (Honeywell)

Let's think of a phone we all used, from around 2005. Essentially, you could make a call on a little screen, but if you flip 15 years down the line, you won't even recognize that the phone looked like that. So, what has changed? It’s semiconductor because it gives much more optionality on what you can do with the compute power along with the software, the combination of that.

01:02:27:23 - 01:02:32:21

Ganesh Moorthy (Microchip)

And I think that's what semiconductors do and what Microchip products do. It's empowering that innovation.

01:02:33:13 - 01:02:41:22

Ryan McCormack (Invesco QQQ)

We say they're innovative because they really commit to long-term development of the various themes, right. They’re deep rooted in research and development.

01:02:42:04 - 01:02:57:19

Karen Snow (Nasdaq)

So, I don't think of this semiconductor industry in a linear way. I think of it very much as an ecosystem. And each one of the players contributing to that ecosystem. For Honeywell, for example, that can be in their approach to building and industrial automation.

01:02:58:08 - 01:03:19:13

Vimal Kapur (Honeywell)

If you see the buildings today versus how they looked many years back, you have face recognition as a primary means to recognize people and make them navigate through the office building or having new sensors for air quality — behind which is the semiconductor, which is enabling that technology. Across the board, semiconductors have impacted every segment in the last 5 to 10 years’ time.

01:03:19:18 - 01:03:43:04

Ganesh Moorthy (Microchip)

We make microchips. How about that, we’re done. What Microchip products do is make those products, through the innovation our customers do, into things that can be better or faster or less expensive. More features. Many of our customers are those who build circuit boards, which use semiconductors. Often they are selling to someone else who is assembling that into a system.

01:03:43:04 - 01:04:02:16

Ganesh Moorthy (Microchip)

And that system is being sold to an end consumer. You know, there's a part of what semiconductors have been doing on a consistent basis. Every year you bring out more functions, more features. The area of medical technology is one in which semiconductors have increasingly had more and more and more impact in terms of better outcomes that you have.

01:04:02:19 - 01:04:16:16

Ganesh Moorthy (Microchip)

Whether that is better outcomes in hospitals, where the big types of machinery are used for ultrasound and scanning and various other things, to all the things that are in the doctor's office, to what you do at home. All of those different things require semiconductors.

01:04:17:13 - 01:04:57:21

Mark Shirey (KLA)

What KLA and inspection and metrology brings is very high sensitivity inspection tools to detect tiny anomalies in the pattern, tiny pattern defects, tiny particles, all of which would kill a semiconductor chip. And that could mean one less smartphone can be delivered because that chip didn't work. As our customers shrink their devices, they introduce new materials, new processes. Every 12 to 24 months, we have upgrade our tools to serve those challenges. So it's really just continuous improvement and innovation to keep up with the semiconductor advancements.

01:04:58:05 - 01:05:20:10

Ryan McCormack (Invesco QQQ)

I think if you go four, five, ten, 20 years ago and asked, you know, where are we going to be? I mean, people can't really fathom the capabilities that we have at our fingertips. But, you know, ultimately, I think it's going to be driven by our desire as a society to be better connected. It's sort of, you know, one of these things where if you want to think big, then sometimes you need to start small.

01:05:23:20 - 01:05:33:07

Invesco QQQ Disclaimer

Consider the Fund's investment objective risks, charges and expenses before investing. Visit Invesco.com for a prospectus with information. Read it carefully before investing.

On-Screen Disclaimer Language

(Section 1)

NOT A DEPOSIT | NOT FDIC INSURED | NOT GUARANTEED BY THE BANK | MAY LOSE VALUE | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

THIS CONTENT SHOULD NOT BE CONSTRUED AS AN ENDORSEMENT FOR OR A RECOMMENDATION TO INVEST HONEYWELL INTERNATIONAL INC, MICROCHIP TECHNOLOGY INC, OR KLA CORP.

NEITHER HONEYWELL INTERNATIONAL INC, MICROCHIP TECHNOLOGY INC, NOR KLA CORP ARE AFFILIATED WITH INVESCO.

There are risks involved with investing in ETFs, including possible loss of money. ETFs are subject to risks similar to those of stocks. Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, then more diversified investments.

Before investing, consider the Fund's investment objectives, risks, charges and expenses. Visit invesco.com for a prospectus containing this information. Read it carefully before investing.

Only three of 101 underlying Invesco QQQ ETF fund holdings are featured. Participation is meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. As of 5/17/23, Honeywell International, Inc. made up 0.97%, KLA Corporation made up 0.43% and Microchip Technology, Inc. made up 0.31% of Invesco QQQ.

As of 5/17/23 Invesco QQQ top ten holdings are: Microsoft Corporation 13.27%, Apple, Inc. 12.53%, Amazon.com, Inc. 6.75%, NVIDIA Corporation 5.51%, Alphabet, Inc. Class A 4.18%, Alphabet, Inc. Class C 4.13%, Meta Platforms, Inc. Class A 3.99%, Tesla, Inc. 3.14%, Broadcom, Inc. 2.03% and PepsiCo, Inc. 1.96%. Holdings are subject to change and should not be considered buy/sell recommendations. See invesco.com for current holdings.

The Nasdaq-100 Index comprises the 100 largest non-financial companies traded on the Nasdaq. An investment cannot be made directly into an index.

Invesco Distributors, Inc. NA2821914

(Section 2)

Nasdaq®, Nasdaq-100 Index®, Nasdaq-100®, and QQQ® are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the "Corporations") and are licensed for use by Invesco.

The Product(s) have not been passed on by the Corporations as to their legality or suitability. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the product(s).

The information contained in the video is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. The Corporations do not make any recommendation to buy or sell any security or any representation about the financial condition of any company.

Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing.

ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

Learn how artificial intelligence (AI) is helping cybersecurity experts preemptively identify malware and secure our digital networks and devices.

00:00:00:01 – 00:00:36:25

Ryan McCormack (Invesco QQQ)

Most companies now had to shift their mindset when it comes to cybersecurity. This isn't just having an antivirus program on your mainframe computer. With all these different interconnected parts, all being able to access the Internet, those are all new access points where somebody can access your network.

The story of QQQ is one of innovation. Invesco QQQ is different from most other ETFs in that it directly tracks the Nasdaq-100.

00:00:37:00 – 00:01:02:00

Emily Spurling (Nasdaq)

The Nasdaq-100 is comprised of the top 100 non-financial companies listed on Nasdaq — companies with a legacy of innovation. Nasdaq thinks about cybersecurity as a horizontal technology that transcends industries.

Cybersecurity challenges that we face today present the opportunity to push the envelope of innovation. Some of the leaders that come to mind are CrowdStrike, Zscaler and Fortinet, as well as many others.

00:01:02:14 – 00:01:08:21

Kavitha Mariappan (Zscaler)

We help people stay safe and continue to be able to innovate, whether it's for work or play.

00:01:09:00 – 00:01:15:19

Michael Sentonas (CrowdStrike)

Cybersecurity today is not a nice to have. It's a necessity for every organization around the world, for every person around the world.

00:01:15:22 – 00:01:23:23

John Maddison (Fortinet)

Cybersecurity is a very dynamic industry. A lot of different technologies which we need to bring to bear to help our customers secure their future.

00:01:24:10 – 00:01:46:00

Kavitha Mariappan (Zscaler)

What Zscaler does is we really are about zero trust security. We look at protecting every organization and user that accesses information on the Internet to securely and safely do their best work. We manage over 270 billion transactions over the Internet daily, as well as block over 100 million threats daily.

00:01:46:05 – 00:02:11:16

Michael Sentonas (CrowdStrike)

If we look at the amount of breaches that hit the press, it's only getting more challenging for organizations. And it's something that I'm really proud of: the work that CrowdStrike has done and continues to do.

We built a company back in 2011. Our focus was to not use legacy approaches to stopping cyber attacks, and we've really focused on building advanced AI algorithms.

00:02:12:00 – 00:02:50:05

John Maddison (Fortinet)

Well, I think Fortinet, what we do is take a very pragmatic view of how fast customers are going and where they're going. We don't think customers are going to one particular specific domain to provide security. It won't be a cloud-only world, it won’t be an on-premise only world, it won't be a data center-only world.

And my analogy there is it used to have a camera, an MP3 player, maybe an alarm clock. Well, they put it all together and converged it into one iPhone. So you've taken multiple products and made it one, which is much more effective from an ROI perspective or cost. It'll be a mix and a hybrid of all those technologies to make sure you can protect everything inside the company.

00:02:50:15 – 00:03:05:15

Michael Sentonas (CrowdStrike)

If you look at the way that we use technology, we really have been building technology around the world to allow us to work from anywhere. The concept of remote work is not a new one. People have been trying to build capability to allow employees to connect and be productive from anywhere.

00:03:06:00 – 00:03:13:20

Kavitha Mariappan (Zscaler)

So much of our life’s actions and business today happens digitally. It is also available out there for threat actors to violate.

00:03:14:00 – 00:03:30:00

John Maddison (Fortinet)

If we go back 20 years ago, there was a big focus on antivirus over laptops because the data was there, and the cybercriminals were trying to get the data from there. And then the data started spreading into the data center and across the network, so then network security vendors became really important.

00:03:30:06 – 00:03:39:05

Kavitha Mariappan (Zscaler)

We're talking about a revolution, about how people needed to rethink, how security needed to look at securing all their core assets and processes.

00:03:39:07 – 00:03:57:09

Michael Sentonas (CrowdStrike)

There's been a lot of shift in cyber attacks in the last ten years. The complexity, the volume, the targeted victims, the amount of money that's being made.

Ten years ago, people would talk about $500 or $1,000 being made by the cyber attackers. Today we talk about $5 million, $10 million attacks.

00:03:57:20 – 00:04:11:12

John Maddison (Fortinet)

Today's companies, they rely on the infrastructure. A lot of those companies can be completely halted if they apply some ransomware or encrypt a controller, which could bring down the whole factory. The company could be losing hundreds of millions of dollars a day.

00:04:12:00 – 00:04:31:16

Michael Sentonas (CrowdStrike)

We provide cybersecurity services, threat intelligence and solutions to stop breaches, and we provide those capabilities to organizations around the world. We use a cloud-based architecture, so wherever a user is, wherever their machines are connecting to, you can connect to them, you can secure them, you can get full visibility.

00:04:31:17 – 00:04:54:17

Kavitha Mariappan (Zscaler)

I think it’s an interesting time to be solving these problems, right? Artificial intelligence and machine learning, being able to analyze a multitude of data, to be able to infer signals and solve very interesting problems. As we look at 5G, as we look at the multitude of devices that are out there, whether, you know, we're looking at IoT or OT, there are going to be so many interesting areas of innovation.

00:04:55:00 – 00:05:24:00

John Maddison (Fortinet)

From Fortinet's perspective, we feel customers will never go down one track. They will be very hybrid for a long time, if not forever. And then security needs to make sure and accommodate that strategy and the customer. Some things will be in the cloud, some things will be provided by the cloud, some things will be on-premise, some things will be in agents.

And so we need to make sure that whatever the customer does with this infrastructure, and its data, and its people, and its users, we can follow and protect that.

00:05:24:02 – 00:05:28:02

Michael Sentonas (CrowdStrike)

Our mission is simply put, we stop breaches. That's what we do for our customers.

00:05:28:15 – 00:05:40:20

Kavitha Mariappan (Zscaler)

The way we think about it is continuing to co-develop and innovate with our customers, but always being there ahead of our customers so that we can deliver the right innovations for them before they need it.

00:05:41:00 – 00:05:52:09

John Maddison (Fortinet)

I think some of the most enjoyable moments are when I'm talking to customers and they explain to me how our technology has helped them drive their business forward, but at the same time protect them.

00:05:52:15 – 00:05:56:22

Emily Spurling (Nasdaq)

The innovation we see at these cybersecurity companies help all companies broadly.

00:05:57:00 – 00:06:05:08

Ryan McCormack (Invesco QQQ)

As technology continues to evolve, the need for cybersecurity solutions, new cybersecurity solutions will likely evolve alongside it.

00:06:09:00 – 00:06:17:01

Invesco QQQ Disclosure

Consider the Fund's investment objective risks, charges and expenses before investing. Visit Invesco.com for a prospectus with information. Read it carefully before investing.

On-Screen Disclaimer Language

(Section 1)

NOT A DEPOSIT | NOT FDIC INSURED | NOT GUARANTEED BY THE BANK | MAY LOSE VALUE | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

THIS CONTENT SHOULD NOT BE CONSTRUED AS AN ENDORSEMENT FOR OR A RECOMMENDATION TO INVEST IN FORTINET, CROWDSTRIKE, ZSCALER.NEITHER FORTINET, CROWDSTRIKE, NOR ZSCALER ARE AFFILIATED WITH INVESCO.

There are risks involved with investing in ETFs, including possible loss of money. ETFs are subject to risks similar to those of stocks. Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, then more diversified investments.

Before investing, consider the Fund's investment objectives, risks, charges and expenses. Visit invesco.com for a prospectus containing this information. Read it carefully before investing.

Only three of 101 underlying Invesco QQQ ETF fund holdings are featured. Participation is meant to help illustrate representative innovation themes, not serve as a recommendation of individual securities. As of 10/02/23, CrowdStrike Holdings Inc Class A made up .33%, Fortinet Inc. made up .39%, and Zscaler Inc made up .20% of Invesco QQQ.

As of 10/02/23 Invesco QQQ top ten holdings are: Apple Inc. 10.87%, Microsoft Corporation 9.56%, Amazon.com Inc. 5.34%, NVIDIA Corporation 4.24%, Meta Platforms Inc Class A 3.82%, Tesla Inc. 3.19%, Alphabet Inc. Class A 3.18%, Alphabet Inc. Class C 3.14%, Broadcom Inc. 2.96% and Costco Wholesale Corporation 2.17%. Holdings are subject to change and should not be considered buy/sell recommendations. See invesco.com for current holdings.

The Nasdaq-100 Index comprises the 100 largest non-financial companies traded on the Nasdaq. An investment cannot be made directly into an index.

Artificial Intelligence (AI) is the simulation of human intelligence processes by computer systems.

The internet of things (IoT) is a network of interrelated devices embedded with technologies for the purpose of connecting and exchanging data with other devices and systems over the internet.

Operational technology (OT) is technology that monitors and controls specific devices and processes within industrial workflows.

Nasdaq and Invesco are not affiliated.

Invesco Distributors, Inc. NA3022917

(Section 2)

Nasdaq®, Nasdaq-100 Index®, Nasdaq-100°, and QQQ® are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the "Corporations") and are licensed for use by Invesco.

The Product (s) have not been passed on by the Corporations as to their legality or suitability. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the product(s).

The information contained in the video is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy.

The Corporations do not make any recommendation to buy or sell any security or any representation about the financial condition of any company.

Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing.

ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

Discover how people are creating and connecting through gaming like never before. They may be the next generation of social networks.

00:00:00:04 - 00:00:19:10

When I think of some of the most innovative companies that make up the Nasdaq-100, I would say a kind of defining characteristic is the ability to change. And I think in this case, you look at an industry that has changed considerably over the past number of decades, it would be the gaming industry.

00:00:19:10 - 00:00:27:11

The Nasdaq-100 is home to innovation and spans many sectors including technology, health care, consumer discretionary as well as many more.

00:00:27:11 - 00:00:55:22

QQQ tracks a Nasdaq-100 Index® 1 to 1, so as soon as a company is added into the index, it's added into QQQ. This group of companies is made up of very innovative, forward thinking, sort of technologically-oriented companies across a variety of different industries, and they're really pushing the boundaries of what's possible. We believe a hallmark of the success of the index is driven by the fact that a lot of these companies spend more on research and development than their peers, consistently investing in their future.

00:00:55:22 -00:01:00:01

The gaming industry is on a meteoric rise. It's way more than entertainment.

00:01:00:01 - 00:01:14:21

Advanced Micro Devices, Electronic Arts and Twitch, a subsidiary of Amazon, have each left their own unique imprint on the way that gamers play, connect and interact.

00:01:14:21 - 00:01:28:14

EA was founded in 1982 with that idea that people should use their personal computers for something more than word processing and spreadsheets, that they can use their personal computers to play.

00:01:28:14 - 00:01:43:12

During the past 20 years, we've seen massive advancements in like CPU and GPU. So graphics from very rudimental 20 years ago are today all the way to really photorealistic.

00:01:43:12 -00:02:15:02

This year we had a hair tool that's basically technology that completely revolutionized how we make characters in a game. With that new technology, we have one of the most realistic representations of any type of hairstyle. Another example is technology that we use for buildings, environments and so on. So it's a tech that's been used by our artists to make massive maps and large worlds with the level of details.

00:02:15:02 - 00:02:41:19

Innovation is something that was always fueling the growth of the industry. Being in that intersection between creativity, entertainment and technology that sparks the innovation, usually driven by the desires of our players.

00:02:41:19 - 00:02:55:08

The evolution of Twitch has really been about recognizing that what works in gaming, in terms of being able to interact, being able to create great content, has also started working in just talk or news, sports, music, a recently launched DJ product.

00:02:55:08 - 00:03:09:16

So I would say our biggest evolution has been continuing to grow the format, building more tools for creators to create great content, interact with the audience, and then applying that in a variety of different domains based on the interest of the audience and streamer.

00:03:09:16 - 00:03:26:00

Twitch has really been in the forefront of that in terms of recognizing that live streaming is a great way to actually build a game with your audience, get early feedback, use streamers as an ambassador, enrolling their audience in those key elements of building a great game that people want to play.

00:03:26:00 - 00:04:09:01

Twitch is really focused on the video platform and delivering that as well as, of course, the community engagement tools. Monetization has been a big part of that. You know, where we've innovated, it started with the simple idea of a subscription, which it's not just a subscription to content, it's access to community. I want to be a community member. I want to be seen as a T-Pain subscriber. I want to wear my badge. I want to use the language of the community, which is emotes. We invented gift subscriptions on top of that, which were ways for community members to bring new people in. And all these monetization mechanics are rooted in that community and the engagement format that was working so well for Twitch.

00:04:09:01 - 00:04:54:09

We started off at AMD really building chips for the PC market, and over time, we've evolved from being a CPU only company to really going on to enabling the best graphics in the world with our GPU. We've really pushed the envelope of this immersive experience, starting with the PC and with enthusiasts, and then enabling the absolute best gaming experience for all users. And of course, we're very proud to power the leading game consoles and through that evolution we've always kept how do we create more detail, more immersion, more exploration for the gamers? But we didn't want to just build products for yet another PC. We want to create a new category of products that are lighter, thinner, sleeker, more beautiful than ever.

00:04:54:09- 00:05:16:05

I'm super excited what AI can do for the gaming industry. Number one, it’ll shorten game development time. Some of these AAA games take three, five, ten years to develop, right? Now with AI rendering, we can hopefully shorten that, so you can see a lot more titles come out. With AI, we can then actually push the boundaries of our tech. Ultimately, that's what we're looking to do for our players.

00:05:19:12 - 00:05:31:05

As I look forward, we're going to see even more of what Twitch really does well in terms of the video technology, the community building side of it, serving the needs of streamers and in the gaming industry broadly.

00:05:32:02 - 00:05:44:21

In the past, people would just play games. Today, they watch, they create, they connect through games. In some ways, you would say that games are the next generation of social networks.

00:05:44:21 - 00:05:58:18

I think the biggest challenge right now is we have many ambitions at AMD, and sometimes deciding what not to do is just as important as deciding what to do. I think if we do all of that right, our future is very bright.

00:05:57:11 - 00:06:17:17

Gaming has forever changed the way that people play and connect and even learn. And even though the industry has seen a ton of change, there's real opportunity to see an industry that looks totally different in 20 years than it does today.

00:06:17:17 - 00:06:25:11 DISCLAIMER

Consider the fund's investment objective, risks, charges and expenses before investing. Visit invesco.com for a prospectus with information. Read it carefully before investing.

Space exploration is opening new investment opportunities as the global space economy rapidly expands and innovates.

Technology can thrive in unexpected places. Learn how three food and beverage industry leaders are innovating.

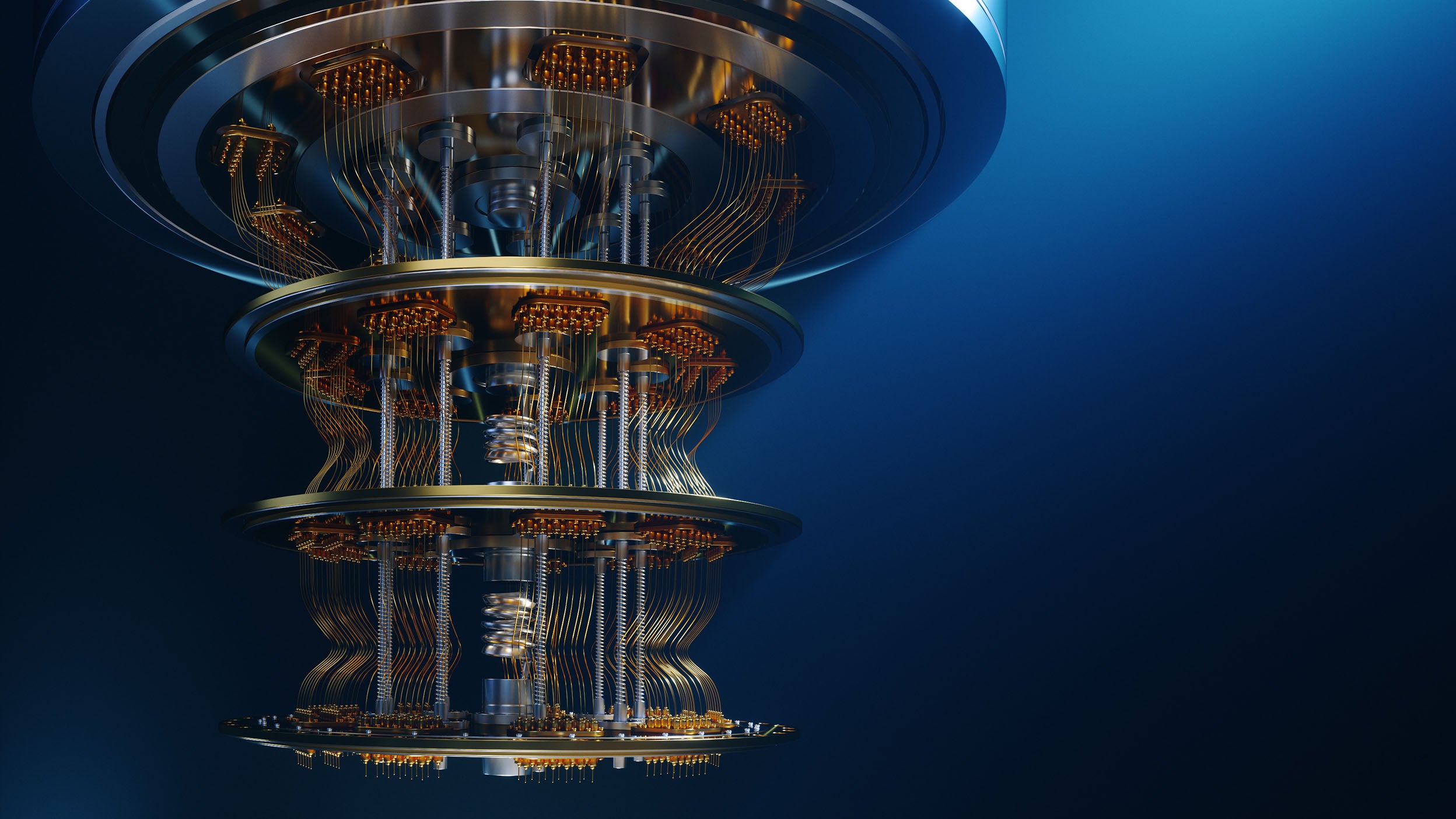

Machine learning and quantum computing technologies are impacting many industries, streamlining many processes and attracting long-term growth

Learn how innovations in the cloud computing space are revolutionizing many Invesco QQQ ETF holdings.

From live events to bingeable TV, learn how streaming services and changing the way we consume media.

How are companies outside of the technology sector impacting Invesco QQQ ETF?

The rise of artificial intelligence (AI) is impacting big tech. Learn more about how industries, from hardware manufactures to software developers, are utilizing AI.

Leisure companies are leveraging AI to innovate experiences, transforming digital entertainment, virtual reality, and travel technology.

Learn how companies within the Nasdaq 100 Index are redefining the food industry

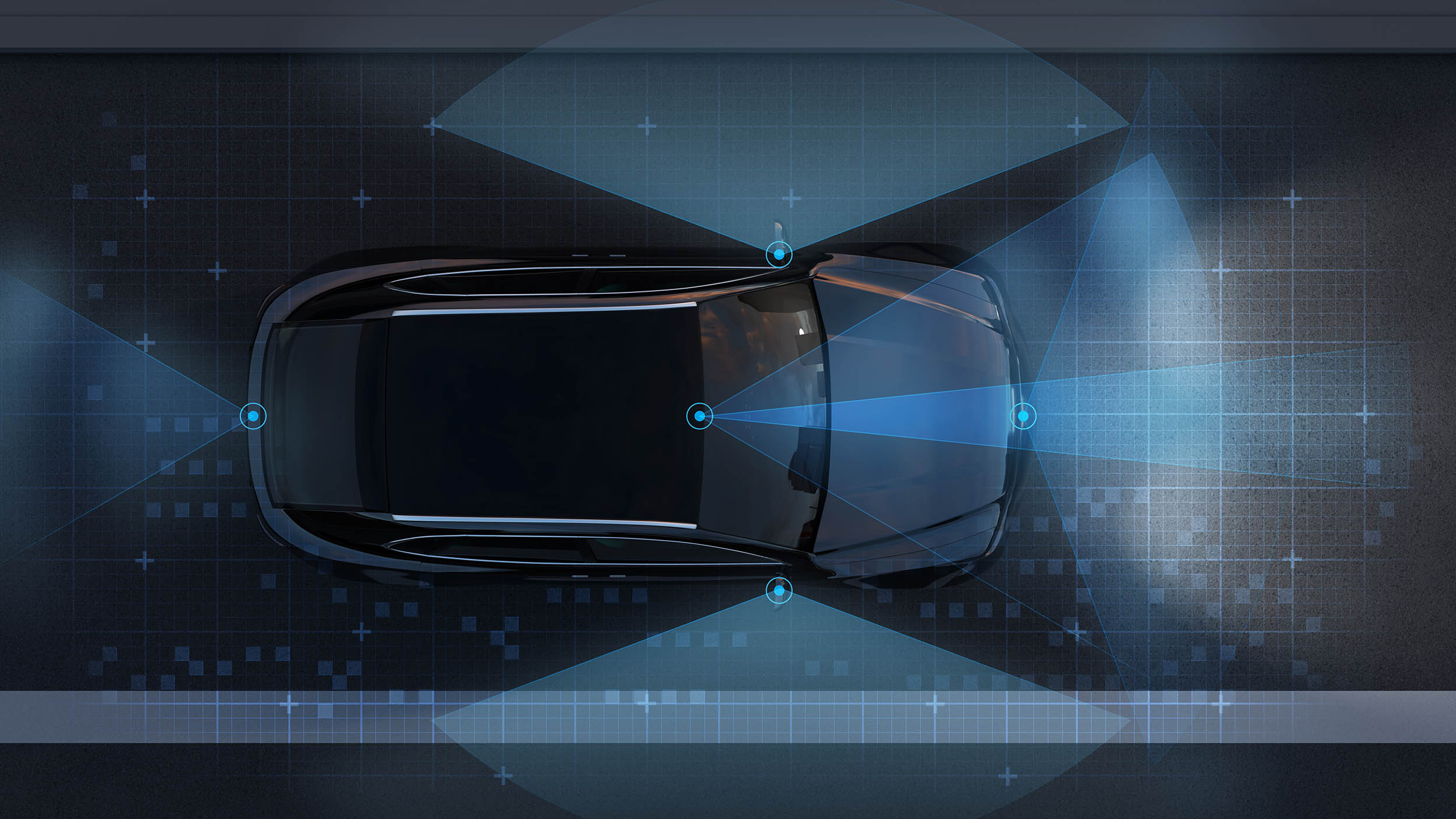

Learn how Invesco QQQ ETF holdings are helping to power self-driving cars and their technologies.

Learn how e-commerce has changed our global economy and about the holding companies behind this growing trend

Learn how the Nasdaq-100 index and Invesco QQQ ETF give investors access to companies that are driving innovation across the global economy.

Learn how digital technologies are revolutionizing the way fans engage with their favorite teams

Investors interested in cryptocurrency may appreciate that the Invesco QQQ ETF offers exposure to underlying holding companies involved in their creation.

Learn how innovations in data privacy are protecting personal data in today’s digital age.

GPUs are playing a large role in the technological revolution that is powering AI and supporting the growth of many technology companies.

Wearable technology is rapidly expanding while providing new technology to user’s everyday lives

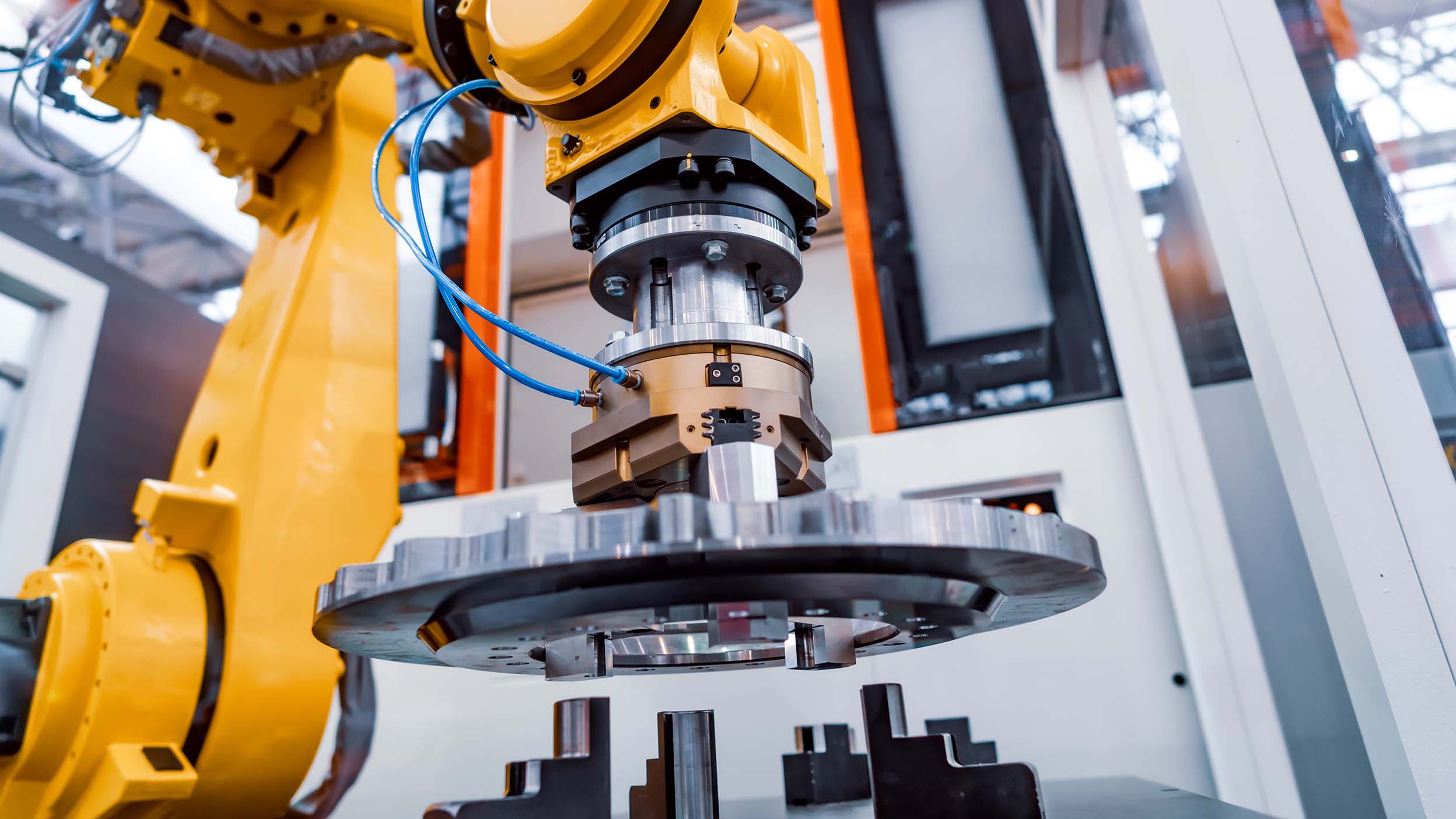

The rapid acceleration of the robotics sector is affecting many industries across the Nasdaq-100

The evolution of biometric technology benefits almost every industry and has many business and personal use cases.

QQQ provides exposure to innovative companies within the entertainment sector, allowing investors to participate in their future growth potential.

Learn how innovation has sparked disruptions in healthcare and showcased the visionary thinking of the companies that comprise Invesco QQQ.

Technology has disrupted just about everything. Learn how innovation is driving something as simple as your favorite cup of coffee.

Explore some of the biggest names in the Nasdaq-100 index. They span sectors to innovate in new ways and diverse businesses.

Select what best describes you:

Invesco does not offer tax advice. Please consult your tax adviser for information regarding your own personal tax situation.