Above the Noise: Is the worst of the banking crisis behind us?

Key takeaways

A hiring slump

The number of US hiring announcements in January and February were the lightest they’ve been in the first two months of the year since 2016.

Policymakers in the spotlight

If the mid-March banking crisis was any indication, policymakers stand ready to respond if further financial challenges unfold.

With hindsight

As we pass the three-year anniversary of the US COVID-19 shutdown, I calculate where a hypothetical investor could be today if they stuck with equities throughout.

Sell in February and avoid the misery? It doesn’t have the same ring to it as “sell in May and go away.” Nonetheless, the early months of the Gregorian calendar have been challenging in recent years: A pandemic and a global shutdown in 2020, the Russian invasion of Ukraine in 2022, and bank failures in 2023. It’s enough to have me looking for a new seasonal investment adage, but I can’t find adequate words to rhyme with February and March. That’s OK — I don’t believe in calendar-based adages anyway. Besides, even if Credit Suisse was a reminder to beware the ides of March, the swift responses from US and Swiss policymakers could have hopes springing that the worst is behind us. We shall see.

Let’s march on to the analysis.

A ‘keep it simple’ strategy

As always, we start with three simple questions.

- Where are we in the business cycle? The most anticipated recession in memory hasn’t arrived, but that doesn’t mean it’s not coming. Banks have already been tightening lending standards, and the recent tumult in the financial system should exacerbate the risk aversion of bankers. If there’s good news, it is that the US equity market had likely already priced for a mild recession.1

- What’s the market telling us about the direction of the economy? The recent deterioration in market sentiment (for example, wider corporate bond spreads2, stronger US dollar3) signals that hopes for a “soft landing” in the economy have faded.

- What will be the policy response? Inflation at 6%.4 Bank failures. Rock meets hard place. That said, the market appears to be turning its attention away from the lagging inflation data and prepping for the Federal Reserve to call it quits.

Tactically, we maintain a defensive posture — fixed income over stocks, defensive sectors/factors over cyclical sectors/factors — as we anticipate tighter lending standards to have an impact on growth and profits.

The national conversation

The failure of Silicon Valley Bank revealed that over 90% of its deposits were above the $250,000 Federal Deposit Insurance Corporation (FDIC) limit.5 It was a long weekend for Chief Financial Officers of many technology start-up businesses and life science companies, who were waiting to learn if or when they would receive access to their cash. Ultimately, it was decided that the FDIC would fully protect depositors with no limit.

Markets breathed a sigh of relief. Pundits cried “moral hazard.” Some even went so far as to channel their inner Andrew Mellon, calling “to purge the rottenness from the system.” For what it’s worth, the purging didn’t work out so well last time.

Speaking of moral hazard, my friend reached out to ask if he should now take his deposits to the riskiest bank offering the highest deposit rate.

Me: Do you have more than $250,000 in a bank account?

Friend: No.

Me: If you did would you be willing to risk that the FDIC may not back all uninsured deposits the next time?

Friend: No

Me: Why did you call me?

Regardless of where you stand in this debate, the takeaway is that greater regulation is expected for the regional banks. Looks like slower nominal growth ahead.

It may be confirmation bias, but …

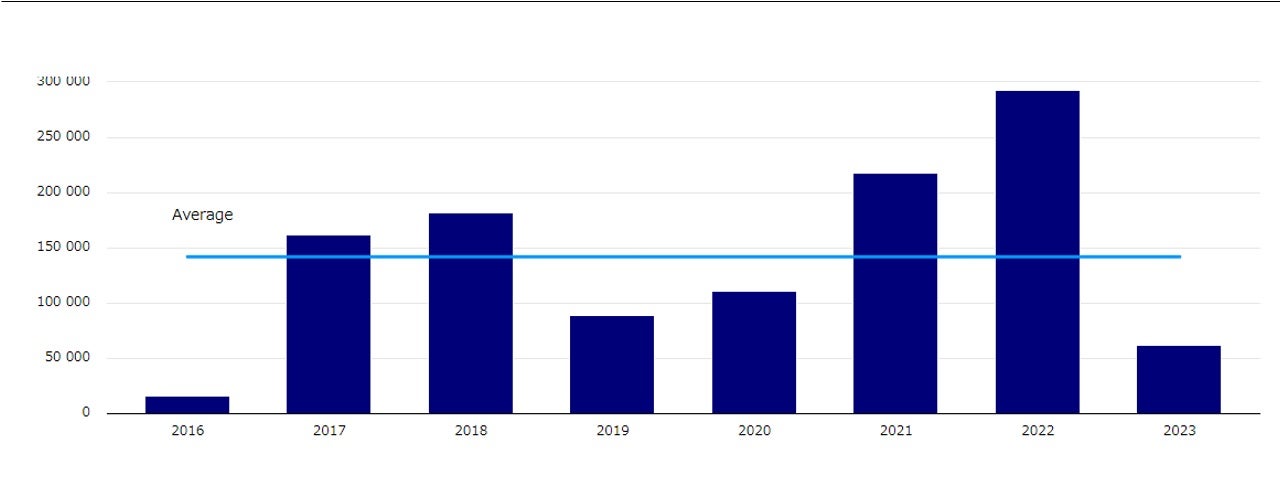

… the job market may finally be slowing. The number of US hiring announcements in January and February were the lightest they’ve been in the first two months of the year since 2016.6

Source: Challenger, Gray, and Christmas Inc., as of March 9, 2023

Automate my job?

Each month I pose a question to ChatGPT — the artificial intelligence-driven chatbot — and assess the response.

Q: What should the US Federal Reserve do next?

A: The Federal Reserve will continue to monitor economic conditions and adjust its policies as needed to promote its goals of maximum employment and price stability while maintaining financial stability.

I would have been impressed if it had said, “The question is to what extent bank stress will persist, how big a credit shock it will generate, how impactful that credit shock will be on activity and inflation and thus the extent to which it may substitute for additional Fed rate hikes.”

I’ll stick with the humans on this one. See below.

It was said

“The events this past week correspond to a 1.5% increase in the fed funds rate. In other words, over the past week, monetary conditions have tightened to a degree where the risks of a sharper slowdown in the economy have increased.”

– Torsten Slok, Chief Economist, Apollo Global Management, in a March 18 note

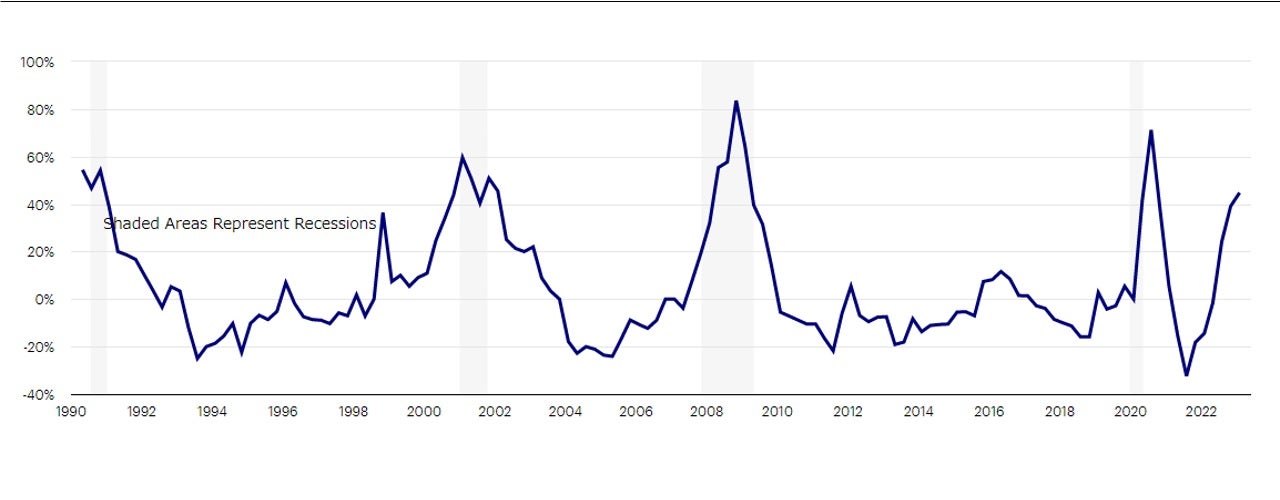

I’m with Torsten. A monetary contraction reduces bank lending supply. The banks were already tightening lending conditions from November to January, and that was before the SVB bank run.7 It’s time for the Fed to end the tightening cycle.

Banks had been tightening lending standards in recent months

Senior Loan Officer Survey: Net percent of domestic respondents tightening standards for commercial & industrial loans for large/medium businesses

Source: US Federal Reserve, 1/31/23.

Since you asked

Here’s a question I’m getting more and more: “Are you concerned that a 2008-type event is looming?”

Financial crises are a part of tightening cycles. However, not all crises resemble 2008.

A fundamental feature of the 2008 global financial crisis is that many of the nation’s largest and most interconnected banks had become insolvent. This was a direct result of their levered exposure to the US housing market. Assets (mortgage-backed securities, for example) were worth far less than stated and the leverage was significantly greater than had been claimed. That’s not the case today. Bank asset quality, in aggregate, is sound.8

Lest I sound too Pollyanna, there are still challenges and still the potential for something else to break. It’s likely that another entity will emerge with significant unrealized losses buried in its portfolios. That’s how the end of tightening cycles tend to play out. However, if the past days are any indication, then policymakers stand ready to respond to the challenges as they unfold. Further, the global financial system is in much better shape than it was in 2008 to withstand such challenges.

Everyone gets a podcast

Justin Livengood, a mid-cap growth manager and a senior research analyst covering the financial services, health care, and real estate sectors, made an emergency visit to the Greater Possibilities podcast to discuss the failure of Silicon Valley Bank.

Here were my primary takeaways:

- This is not a systemic credit issue, which is what we experienced in 2008. The credit picture in the banking industry is still quite clean, Justin told us. While banks have seen earnings estimates fall as they struggle to grow profitably, they haven’t seen too many loans and non-performing assets slip past due, which tends to be an early sign of a bank crisis.

- After the dust settles, banks will have to recalibrate expectations based on the inflows and/or outflows they experienced. Midsize and regional banks can expect plenty of new regulations and capital requirements.

- Rising interest rates were already slowing the economy’s growth, and the SVB failure should nudge it a little more in that direction. The Fed may need to be a little more dovish going forward than they would have been otherwise.

- The optimistic view for investors is that we are reestablishing a proper equilibrium in monetary policy that may help provide a stronger base for the economy and the stock market to operate from in the next two to three years.

With hindsight

We recently marked the three-year anniversary of the day that the US shut down to prevent the spread of COVID-19 — March 15, 2020. Memories of the day include wiping groceries, putting mail in the oven, and steeling nerves to not flee the market. For many, nerves did fray. In the subsequent days, investors allocated over $1 trillion to money market strategies (then yielding virtually nothing) and withdrew shocking amounts of money from equity funds.9 The market bottomed six trading days later.10

Consider three hypothetical investors11 who had invested $100,000 into the US equity market on Jan. 2, 2020, and how they would have fared as of March 15, 2023:

- Investor A, to this day, has not touched the money. The initial investment, which had fallen to a low of $69,000, would now be worth over $126,000.

- Investor B moved half of the investment into a money market strategy on the day the nation shut down. The portfolio of 50% equity/50% money market would only be worth just shy of $107,000 today.

- Investor C added an additional $50,000 to the equity portfolio on March 15, 2020. The account would have grown to over $200,000.

In this scenario, adding more equities in a time of extreme crisis put Investor C ahead of the others.

On the road again

My early March travels took me to Dallas, Texas, where not even a nearby tornado could derail our scheduled meeting. It’s a bit unsettling when, in a room full of a few hundred people, everyone gets an iPhone warning at the same moment. I was, however, surprisingly comforted when the hotel staff informed me that they would come to get us if we had to take shelter in the basement. Fortunately, that never happened.

I suppose the trip was somewhat apropos of what awaited us in the financial markets over the next weeks. Here’s to hoping that the current challenges pass without significant incident, as they did in Dallas. In this instance, my comfort comes from a belief that policymakers stand ready to support the financial system.

On to April, which T.S. Eliot called a cruel month. Why? According to Eliot, April is when we dare to hope, and nothing can be crueler than hope. I disagree. For investors, prolonged pessimism has tended to be crueler than hope. Showers bring flowers.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2023-018

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html