Three sectors to look out for as Chinese equities headwinds abated

China market is back on track

Looking back to the past few years, investors have four major concerns over Chinese equities, but recent developments have shown that the risks are much lowered as we entered 2023.

1. COVID policy turnaround

- China’s reopening came sooner than expected and we have seen gradual normalization of business activities and travels subsequently.

- Domestic and international flights remained resilient after the CNY holiday. International flights increased by 50% m/m in February.1

2. Strong signal of support for Internet sector

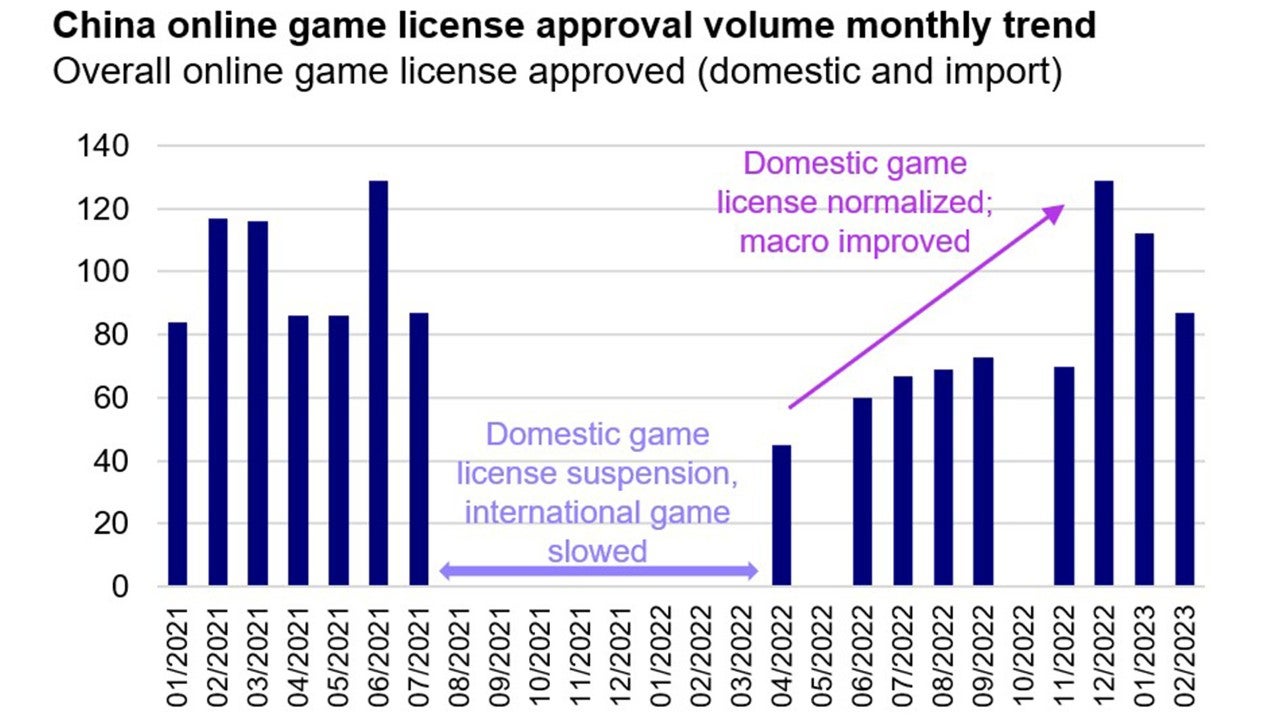

- The regulatory headwinds reduced meaningfully, in particular the Internet and online gaming sectors. There has been no negative headline about China’s Internet sector for a long time.

- Chinese regulatory body has approved 87 new video game licenses in February, more than any monthly domestic approval tally from 2022.2

3. Property sector is on recovery

- Ease of restrictions and change in policy stance although it takes time to see a strong recovery in demand.

- An encouraging +26% YoY growth in 60-city sales were recorded in the second week of February.3

4. ADR de-listing risk abated

- PCAOB has largely finished the first phase inspection of the audit documents of US-listed Chinese companies in Hong Kong with no major issue, signaling an ease of ADR de-listing risk.4

- This is a substantial improvement with mechanism to resolve the issue.

Opportunities ahead in Chinese equities

As macro environment has become more benign, we are positive to the following sectors riding on the uptrend of Chinese economy.

1. AI related sector – a new era in technology

- AI technology is widely adopted in China, penetrating across multiple areas, including e-commerce, retail, healthcare.

- We are positive on the upcoming investment opportunities for the market as we see rapid developments of new technology being welcomed in the market.

- For instance, several Chinese tech giants announced their plans to develop ChatGPT-style technology in view of the success overseas.5

- We also see pharmaceutical companies collaborating with AI company for new drug designs.6

- The economic impact of AI will be huge, it is expected that China will invest $27 bn in AI and account for ~9% global AI investments by 2026.7

2. Lifestyle and consumer sectors- riding on the reopening trend

- China’s reopening is the major driver of its economic recovery, led by a surge in consumer demand.

- We believe the restaurants, food and beverages industries, and food delivery will be key beneficiaries of reopening.

- For example, average restaurant spending increased by 10.8% and restaurants dine-in consumption surged 15.4% yoy after reopening.8

- We believe the growth momentum will sustain in a full-scale reopening and greater people mobility.

3. Internet sector – a modest recovery after regulatory easing

- With better Internet sector outlook, online advertising is on recovery, particularly in game ads as it surged 25-30% YoY during CNY.9

- There has also been a growth in the no. of online game users, where peak daily users surged 9% in 2023 comparing to the same period of last years.9

- We are positive to the continuous policy support and sustainable recovery in the Internet sectors.

Source: Goldman Sachs Global Investment Research. February 2023

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2023-022

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html