How sticky is inflation?

Key takeaways

Signs of progress

Money supply growth collapsed, goods inflation improved, and consumer expectations for inflation are falling.

Still-sticky areas

The job market is tight, average hourly earnings growth slowed, and service inflation is still elevated.

Short-term outlook

Markets may retrace early 2023 gains but recover as inflation reaches Fed’s perceived “comfort zone.”

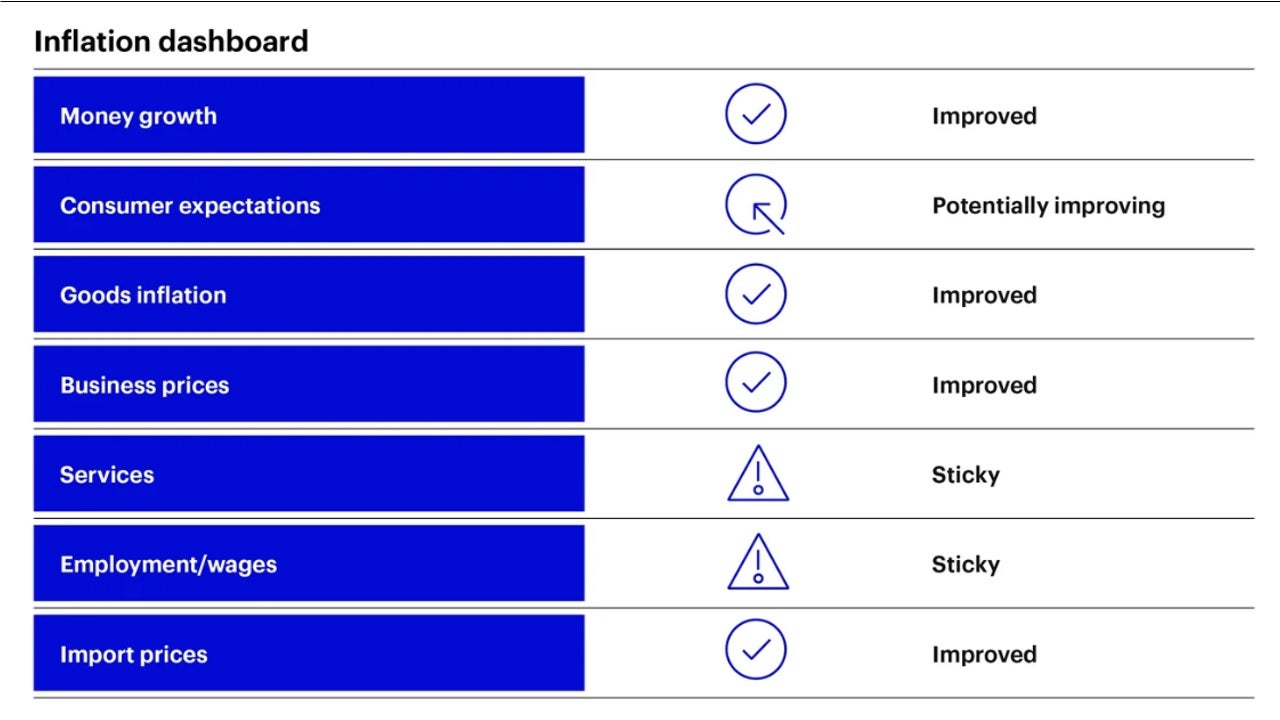

Inflation appears to be improving in general. It may still be too elevated, however, to appease investors and policymakers. So just how sticky will inflation be? To answer that important question and assess the ongoing path of inflation and progress to date, we’ve created a dashboard that summarizes the key inflation indicators we’re watching closely. Get a quick summary of the status below, plus dig into the data and charts in our chartbook: How sticky is inflation?

Money growth: Improved

Money supply growth has plunged as the Federal Reserve (Fed) has tightened monetary conditions and fiscal spending slowed meaningfully. The M2 money supply is now flat over the past 12 months.1 The growth (or lack thereof) in the money supply tends to lead inflation by roughly 12 to 18 months. From that lens, one could deduce that inflation may decline rapidly in the coming months.

Consumer expectations: Potentially improving

US consumer one-year inflation expectations have been rolling over but remain above the Fed’s perceived “comfort zone.” It doesn’t appear, however, that long-term inflation expectations are becoming unanchored. The Fed is likely taking comfort that longer-term inflation expectations currently sit within their perceived “comfort zone.”2

Goods inflation: Improved

Supply-chain challenges have eased, and retailers have been successfully rebuilding inventories. The inventory to sales ratio from the US Census Bureau (as of Dec. 31, 2022) is now at the highest level since the early days of the pandemic. The goods inflation story has largely been easing and is likely to continue to do so, even as consumer spending remains resilient.

Business prices: Improved

Business sentiment regarding future inflation has eased meaningfully according to the Institute for Supply Management (ISM) Manufacturing Prices Paid Index (as of Jan. 31, 2023.) The number of purchasing managers reporting backlogs on orders has plunged. The number of purchasing managers reporting slower delivery times has also fallen drastically.

Services: Sticky

Concerns still linger about service inflation. The service categories in the US Consumer Price Index (as of Jan. 31, 2023) shows that shelter prices remain elevated but may be poised to decline. Transportation and recreation costs are also high, as anyone who has recently attempted to fly, rent a car, or attend an event can attest. One positive to note is that the used cars and trucks component of the Consumer Price Index has fallen by 11.6% over the past 12 months.

Employment/wages: Sticky

The job market remains very tight as highlighted by the 3.6% unemployment rate (as of Jan. 31, 2023). Average hourly earnings growth, which has already been slowing from elevated levels, has tended to peak ahead of recessions and coincident with peak employment. Workers surveyed in January by the Federal Reserve Bank of New York expect their income growth to fall from 4.6% to 3.3%, the biggest one-month decline in the survey on record.

Import prices: Improved

Slowing consumer demand has hit prices for containers. Freight costs have fallen from over $10,000 per 40-foot box at the height of the supply-chain challenges to under $2,000 in mid- February.3 The import prices of goods into the US have been moderating in kind according to the Bureau of Labor Statistics Import Price Index (as of Jan. 31, 2023).

Conclusion

Inflation is moderating and will continue to decline over the next year, in our view. It’s unlikely to decline fast enough to appease policymakers suggesting more tightening is in the offing. As a result, in the short term we would expect markets to retrace early 2023 gains only to recover as inflation ultimately travels towards the Fed’s perceived “comfort zone.”

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2023-019

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html