Invesco ETFs

Explore our lineup of ETFs and see how they can be cost-effective and tax-efficient for maximizing your investments and building long-term wealth.

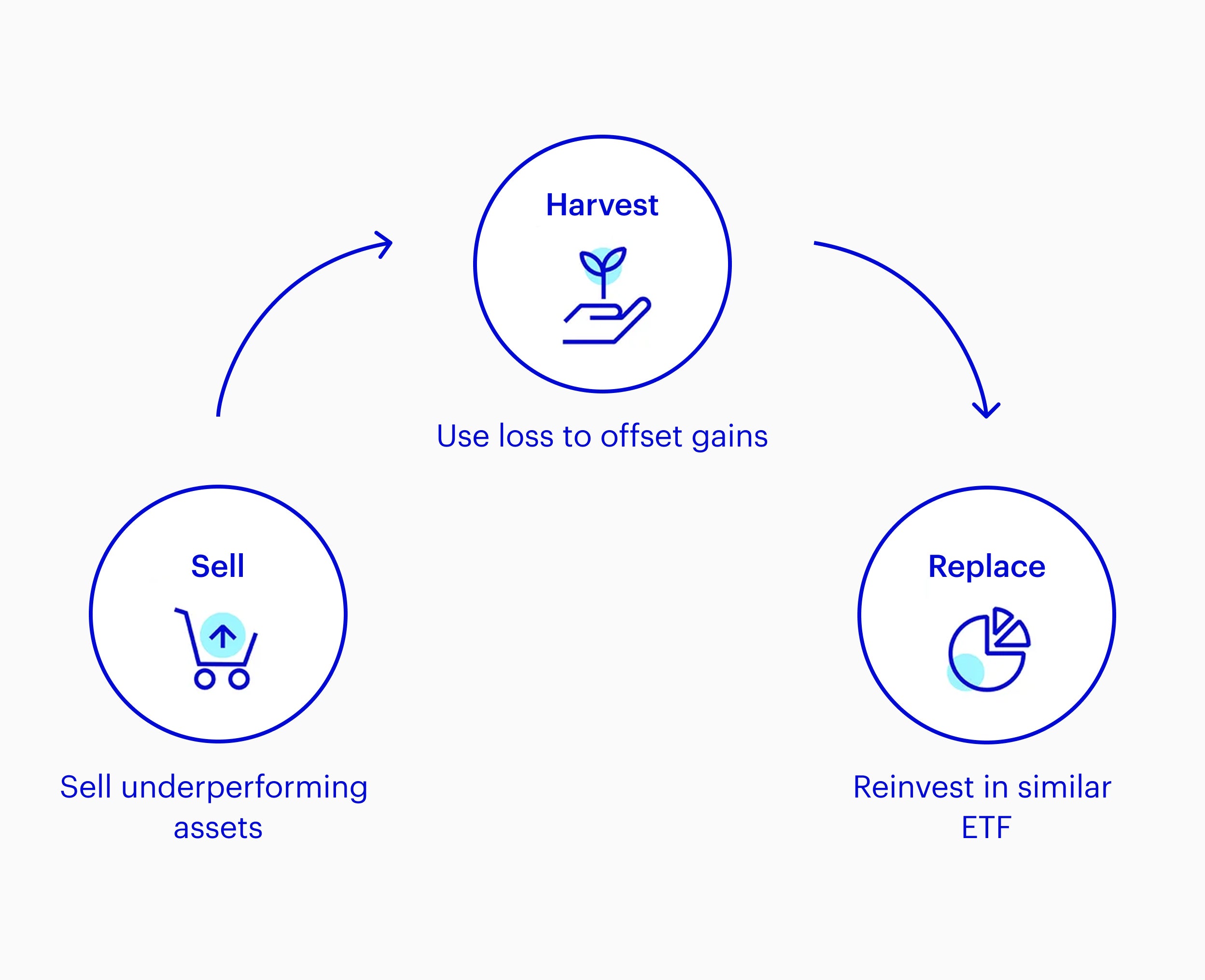

Even if you sell an investment for tax-loss harvesting purposes, you can still invest in the asset class or type by swapping it for a similar ETF. This may allow your clients to stay invested in a similar exposure without violating the Internal Revenue Service wash-sale rule.1

| Fund | Ticker | Description | Asset class | Learn more |

|---|---|---|---|---|

| Invesco S&P 500 Equal Weight ETF | RSP | Equal weight exposure to the largest 500 companies in the US as defined by S&P. | US Equity | Fact sheet |

| Invesco NASDAQ 100 ETF | QQQM | Exposure to the 100 largest domestic and international nonfinancial companies listed on Nasdaq. | US Equity | Fact sheet |

| Invesco Senior Loan ETF | BKLN | Exposure to interest-paying, senior loans issued by banks or other lending institutions to corporations, partnerships or other entities. | US Fixed Income | Fact sheet |

| Invesco S&P MidCap Quality ETF | XMHQ | Exposure to mid-cap U.S. companies with strong quality characteristics, focusing on financial health and stability, which may offer potential for long-term growth and lower volatility. | US Equity | Fact sheet |

| Invesco Total Return Bond ETF | GTO | Exposure to a diversified portfolio of US and international bonds, aiming to deliver total return through a combination of current income and capital appreciation, while managing risk across various fixed-income sectors. | US Fixed Income | Fact sheet |

Help your clients keep more of what they earn by implementing these two tax strategies.

No matter what your clients are looking to achieve, our ETFs can help you build customized portfolios with precision and confidence.

Market selloffs can be painful, but they provide opportunities for you to turn losses into tax savings for your clients. Here are important things to know about tax-loss harvesting with ETFs.

Invesco’s lineup of more than 230 ETFs gives you many options for trimming positions that are trading at a loss and buying different funds with similar objectives and exposures.

NA4298789

Since ordinary brokerage commissions apply for each ETF buy and sell transaction, frequent trading activity may increase the cost of ETFs.

The Internal Revenue Service (IRS) has guidelines commonly referred to as the “wash sale” rule. In short, it outlines that investors cannot buy a “substantially identical” security 30 days before or after the sale of the funds chosen when conducting tax loss harvesting. Speak with a tax professional to confirm the exposure being replaced does not violate the IRS “wash sale” rule.

Invesco does not offer tax advice. Please consult your tax adviser for information regarding your own personal tax situation.

Internal Revenue Service (IRS) Wash-Sale Rule: A regulation that prohibits taxpayers from claiming a tax deduction for a security sold in a wash sale. A wash sale occurs when an individual sells a security at a loss and repurchases the same or a substantially identical security within 30 days before or after the sale. This rule is designed to prevent taxpayers from claiming artificial losses for tax benefits.